The automotive market in India is a dynamic landscape that reflects shifting consumer preferences, economic conditions, and technological advancements. In November 2024, the top 25 most selling cars list is a testament to the evolving demands of Indian car buyers. From compact hatchbacks to robust SUVs and family-friendly MUVs, the market continues to reveal changing consumer priorities. In this blog, we’ll explore the trends that are shaping the Indian car market, breaking down sales data by brand and body style while providing statistical insights into year-over-year (Y-o-Y) performance.

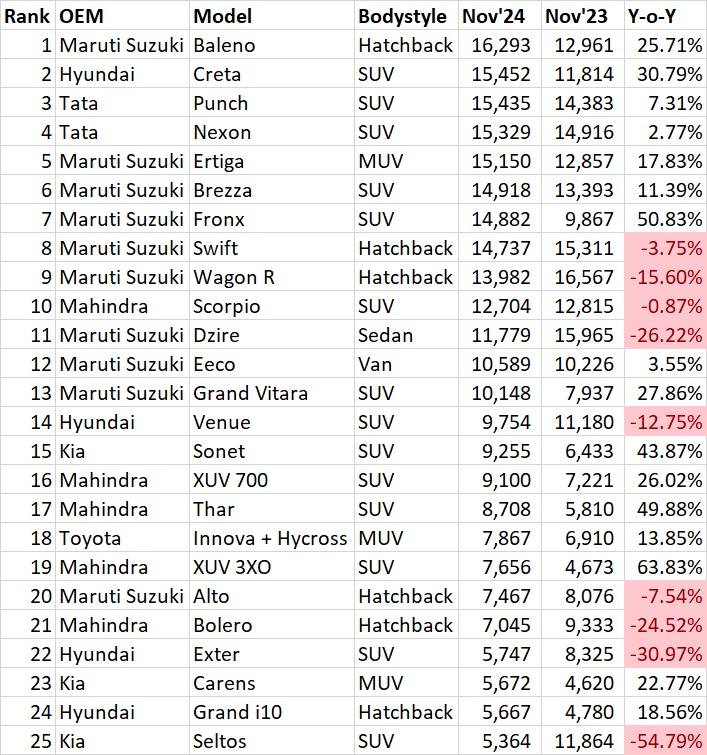

Top 25 Most Selling Cars in November 2024

1. Maruti Suzuki: Dominating the Hatchback and SUV Segments

Maruti Suzuki has been a consistent leader in the Indian car market, particularly excelling in the hatchback and SUV segments. The company’s continued dominance can be attributed to its strong product portfolio, which blends affordability, fuel efficiency, and advanced features.

- Maruti Suzuki Baleno (Hatchback): 16,293 units sold (Y-o-Y growth: 25.71%)

- Maruti Suzuki Swift (Hatchback): 14,737 units sold (Y-o-Y decrease: -3.75%)

- Maruti Suzuki Wagon R (Hatchback): 13,982 units sold (Y-o-Y decrease: -15.60%)

- Maruti Suzuki Ertiga (MUV): 15,150 units sold (Y-o-Y growth: 17.83%)

- Maruti Suzuki Brezza (SUV): 14,918 units sold (Y-o-Y growth: 11.39%)

- Maruti Suzuki Fronx (SUV): 14,882 units sold (Y-o-Y growth: 50.83%)

Market Trend: Preference for Compact, Fuel-Efficient Cars

Maruti Suzuki’s success with Baleno and Swift reflects the strong market preference for compact, fuel-efficient vehicles that offer value for money. These hatchbacks are well-suited to the needs of city dwellers, especially as fuel prices and environmental concerns continue to shape purchasing decisions. The Brezza and Fronx further emphasize the growing demand for feature-rich compact SUVs, catering to consumers who want more space and versatility without compromising on fuel efficiency.

2. Hyundai: The Strong SUV Challenger

Hyundai continues to be a strong competitor in the SUV market, particularly with the Creta, which is the company’s best-selling model in November 2024. The brand’s vehicles are known for their modern design, premium features, and strong after-sales service.

- Hyundai Creta (SUV): 15,452 units sold (Y-o-Y growth: 30.79%)

- Hyundai Venue (SUV): 9,754 units sold (Y-o-Y decrease: -12.75%)

- Hyundai Exter (SUV): 5,747 units sold (Y-o-Y decrease: -30.97%)

- Hyundai Grand i10 (Hatchback): 5,667 units sold (Y-o-Y growth: 18.56%)

Market Trend: The Rise of Premium SUVs

The Creta’s performance speaks volumes about the growing preference for premium SUVs in the Indian market. With its blend of modern design, advanced tech, and spacious interiors, it has become the go-to choice for those looking for a mid-size SUV that offers more than just basic functionality. The Venue and Exter, despite some declines in sales, still indicate a healthy demand for compact SUVs, particularly in urban areas.

3. Tata: A Strong Contender in the SUV Market

Tata Motors is increasingly making its mark with its robust line-up of SUVs. The Punch and Nexon are standout performers, particularly in the compact SUV segment.

- Tata Punch (SUV): 15,435 units sold (Y-o-Y growth: 7.31%)

- Tata Nexon (SUV): 15,329 units sold (Y-o-Y growth: 2.77%)

Market Trend: Preference for Safety and Value

Tata has successfully capitalized on the market’s growing emphasis on vehicle safety, with both the Punch and Nexon being equipped with advanced safety features and achieving high NCAP safety ratings. This focus on safety, combined with the brand’s affordable pricing, appeals to a wide range of buyers looking for a compact SUV that offers both value and peace of mind.

4. Mahindra: The SUV Powerhouse

Mahindra has carved a niche for itself as a brand that offers rugged, adventure-ready vehicles. The brand’s popularity is particularly evident in the success of the Scorpio and Thar models, which continue to perform well in the SUV segment.

- Mahindra Scorpio (SUV): 12,704 units sold (Y-o-Y decrease: -0.87%)

- Mahindra Thar (SUV): 8,708 units sold (Y-o-Y growth: 49.88%)

- Mahindra XUV700 (SUV): 9,100 units sold (Y-o-Y growth: 26.02%)

Market Trend: The Rise of Adventure SUVs

Mahindra’s Thar exemplifies the shift toward adventure-oriented vehicles, appealing to buyers seeking a blend of off-road capability and city convenience. The XUV700, on the other hand, highlights the growing demand for premium SUVs that combine ruggedness with luxury. Mahindra’s strong sales performance indicates a significant shift in consumer preference toward versatile, capable SUVs that can handle both urban and off-road terrains.

5. Kia: A Rising Star in the SUV Segment

Kia has emerged as a strong player in the SUV segment with models like the Sonet, Carens, and Seltos. The brand has quickly established a reputation for producing stylish, tech-packed vehicles that cater to young, tech-savvy buyers.

- Kia Sonet (SUV): 9,255 units sold (Y-o-Y growth: 43.87%)

- Kia Carens (MUV): 5,672 units sold (Y-o-Y growth: 22.77%)

- Kia Seltos (SUV): 5,364 units sold (Y-o-Y decrease: -54.79%)

Market Trend: Compact SUVs and Family Cars on the Rise

Kia’s Sonet is a clear indication of the increasing preference for compact SUVs, which offer the perfect balance between space, performance, and affordability. The Carens also reflects the market’s growing demand for multi-purpose vehicles (MPVs) that cater to families seeking practicality and comfort. Despite a significant decline in Seltos sales, Kia’s strong performance in both compact SUVs and family cars suggests a broader trend toward vehicles that can serve both urban and family needs.

6. Toyota: MUVs and Family Cars Lead the Charge

Toyota’s success with the Innova and Innova Hycross models underscores the continued importance of MUVs (multi-utility vehicles) in the Indian market. These vehicles remain popular among large families and those who prioritize comfort, space, and reliability.

- Toyota Innova + Hycross (MUV): 7,867 units sold (Y-o-Y growth: 13.85%)

Market Trend: Demand for Spacious Family Vehicles

Toyota’s strong performance in the MUV segment highlights a consistent consumer preference for larger, more spacious vehicles. As urbanization increases and families grow, consumers are gravitating towards vehicles that offer ample room for passengers and luggage without compromising on comfort or safety.

Conclusion: Market Trends and the Future Outlook

The top 25 most selling cars in November 2024 reflect a market that is increasingly driven by consumer demand for compact SUVs, safety features, and family-friendly vehicles. While hatchbacks remain a dominant force, there is a clear shift towards premium and adventure-ready SUVs, with brands like Hyundai, Tata, and Mahindra leading the charge.

The data also reveals a growing demand for vehicles that offer more than just basic transportation. Consumers are now prioritizing factors like safety, fuel efficiency, space, and tech-driven features, making it essential for car manufacturers to adapt to these changing preferences.

As we look to the future, the market trends will continue to evolve, with an increased focus on electric vehicles (EVs), advanced safety features, and sustainable practices. Understanding these preferences will be crucial for both car buyers and industry stakeholders in navigating the shifting automotive landscape.