India’s leading carmaker, Maruti Suzuki, posted a varied sales performance in May 2025, showcasing robust growth in some segments and challenges in others. This detailed breakdown of Maruti Suzuki May 2025 sales explores model-wise results, year-on-year (Y-o-Y) and month-on-month (M-o-M) trends, and what these numbers reveal about the brand’s position in a rapidly evolving Indian automotive market. From standout performers like the Dzire to struggling hatchbacks like the Alto, the data reflects shifting consumer preferences and competitive pressures. Let’s dive into the numbers and see what’s driving Maruti Suzuki’s journey.

Model-wise Sales Breakdown

| Make | Model | May’25 | May’24 | Growth Y-O-Y (%) | May’25 | Apr’25 | Growth M-O-M (%) |

| Maruti Suzuki | Dzire | 18,084 | 16,061 | 13% | 18,084 | 16,996 | 6% |

| Maruti Suzuki | Ertiga | 16,140 | 13,893 | 16% | 16,140 | 15,780 | 2% |

| Maruti Suzuki | Vitara Brezza | 15,566 | 14,186 | 10% | 15,566 | 16,971 | -8% |

| Maruti Suzuki | Swift | 14,135 | 19,393 | -27% | 14,135 | 14,592 | -3% |

| Maruti Suzuki | Wagon R | 13,949 | 14,492 | -4% | 13,949 | 13,413 | 4% |

| Maruti Suzuki | Fronx | 13,584 | 12,681 | 7% | 13,584 | 14,345 | -5% |

| Maruti Suzuki | Eeco | 12,327 | 10,960 | 12% | 12,327 | 11,438 | 8% |

| Maruti Suzuki | Baleno | 11,618 | 12,842 | -10% | 11,618 | 13,180 | -12% |

| Maruti Suzuki | Grand Vitara | 5,197 | 9,736 | -47% | 5,197 | 7,154 | -27% |

| Maruti Suzuki | Alto | 4,970 | 7,675 | -35% | 4,970 | 5,606 | -11% |

| Maruti Suzuki | XL6 | 3,507 | 3,241 | 8% | 3,507 | 4,140 | -15% |

| Maruti Suzuki | Celerio | 1,861 | 3,314 | -44% | 1,861 | 1,474 | 26% |

| Maruti Suzuki | Ignis | 1,855 | 2,104 | -12% | 1,855 | 1,936 | -4% |

| Maruti Suzuki | S-Presso | 1,806 | 2,227 | -19% | 1,806 | 726 | 149% |

| Maruti Suzuki | Jimny | 682 | 274 | 149% | 682 | 431 | 58% |

| Maruti Suzuki | Ciaz | 458 | 730 | -37% | 458 | 321 | 43% |

| Maruti Suzuki | Invicto | 223 | 193 | 16% | 223 | 201 | 11% |

Dzire

- May 2025 Sales: 18,084

- Y-o-Y Growth: +13%

- M-o-M Growth: +6%

The Dzire continues to shine as a compact sedan star in Maruti Suzuki May 2025 sales. With a solid 13% Y-o-Y increase and a 6% M-o-M uptick, it’s clear that buyers value its blend of affordability, fuel efficiency, and modern features. Its consistent demand makes it a cornerstone of Maruti’s lineup.

Ertiga

- May 2025 Sales: 16,140

- Y-o-Y Growth: +16%

- M-o-M Growth: +2%

The Ertiga remains a go-to choice for families and fleet operators. A 16% Y-o-Y surge highlights its strong appeal in the MPV segment, while a modest 2% M-o-M gain shows steady demand. Its versatility keeps it high in Maruti Suzuki May 2025 sales rankings.

Vitara Brezza

- May 2025 Sales: 15,566

- Y-o-Y Growth: +10%

- M-o-M Growth: -8%

The Vitara Brezza, a compact SUV favorite, saw a healthy 10% Y-o-Y growth, reinforcing its popularity among urban buyers. However, an 8% M-o-M dip suggests a slight cooling off from April’s highs, possibly due to seasonal fluctuations or rising competition.

Swift

- May 2025 Sales: 14,135

- Y-o-Y Growth: -27%

- M-o-M Growth: -3%

The Swift, despite its refreshed appeal, faced a surprising 27% Y-o-Y drop, a stark contrast to its triple-digit growth in April. A 3% M-o-M decline indicates a stabilization after last month’s normalization. Still, its youthful design keeps it relevant in Maruti Suzuki May 2025 sales.

Wagon R

- May 2025 Sales: 13,949

- Y-o-Y Growth: -4%

- M-o-M Growth: +4%

The Wagon R, once a volume leader, saw a modest 4% Y-o-Y decline but managed a 4% M-o-M increase. Its practicality still resonates, but the shift toward SUVs is challenging its dominance in the hatchback segment.

Fronx

- May 2025 Sales: 13,584

- Y-o-Y Growth: +7%

- M-o-M Growth: -5%

The Fronx, with its crossover charm, posted a 7% Y-o-Y gain, showing steady interest. A 5% M-o-M drop suggests a minor slowdown, but its SUV-inspired design keeps it competitive in Maruti Suzuki May 2025 sales.

Eeco

- May 2025 Sales: 12,327

- Y-o-Y Growth: +12%

- M-o-M Growth: +8%

The Eeco, a commercial and utility favorite, delivered a strong 12% Y-o-Y and 8% M-o-M growth. Its no-frills reliability makes it a steady contributor to Maruti Suzuki May 2025 sales, especially for small businesses.

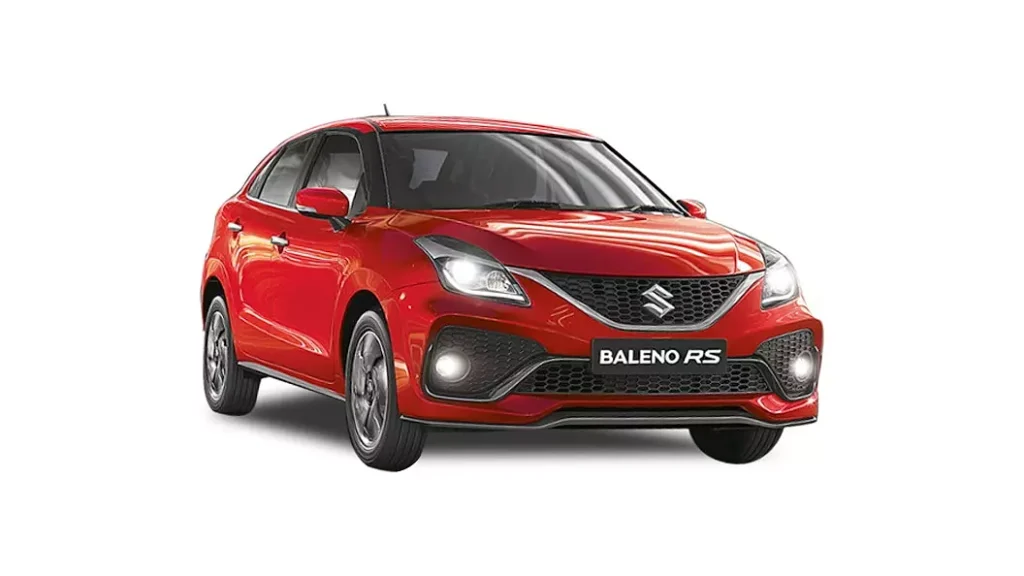

Baleno

- May 2025 Sales: 11,618

- Y-o-Y Growth: -10%

- M-o-M Growth: -12%

The premium hatchback Baleno faced a 10% Y-o-Y and 12% M-o-M decline. Despite its modern features, it’s struggling against newer competitors and shifting buyer preferences toward SUVs.

Grand Vitara

- May 2025 Sales: 5,197

- Y-o-Y Growth: -47%

- M-o-M Growth: -27%

The Grand Vitara’s sharp 47% Y-o-Y and 27% M-o-M drops are concerning. Despite its hybrid technology and premium positioning, intense competition in the midsize SUV segment is impacting its traction in Maruti Suzuki May 2025 sales.

Alto

- May 2025 Sales: 4,970

- Y-o-Y Growth: -35%

- M-o-M Growth: -11%

The Alto continues its downward trend, with a 35% Y-o-Y and 11% M-o-M decline. As buyers gravitate toward feature-rich SUVs, this entry-level hatchback is losing ground rapidly.

XL6

- May 2025 Sales: 3,507

- Y-o-Y Growth: +8%

- M-o-M Growth: -15%

The XL6, a premium MPV, posted an 8% Y-o-Y gain but saw a 15% M-o-M drop. Its appeal to affluent families remains, but monthly fluctuations suggest sensitivity to pricing or competition.

Celerio

- May 2025 Sales: 1,861

- Y-o-Y Growth: -44%

- M-o-M Growth: +26%

The Celerio’s 44% Y-o-Y decline is worrying, but a 26% M-o-M jump offers hope. Without significant updates, it may struggle to regain its footing in the hatchback market.

Ignis

- May 2025 Sales: 1,855

- Y-o-Y Growth: -12%

- M-o-M Growth: -4%

The Ignis, with its quirky styling, saw a 12% Y-o-Y and 4% M-o-M decline. Its niche urban appeal keeps it afloat, but growth remains elusive.

S-Presso

- May 2025 Sales: 1,806

- Y-o-Y Growth: -19%

- M-o-M Growth: +149%

The S-Presso’s standout 149% M-o-M surge is a bright spot, though its 19% Y-o-Y drop reflects challenges in the micro-SUV space. Its budget-friendly design still attracts some buyers.

Jimny

- May 2025 Sales: 682

- Y-o-Y Growth: +149%

- M-o-M Growth: +58%

The Jimny, a niche off-roader, continues its impressive run with a 149% Y-o-Y and 58% M-o-M growth. Its cult following drives low-volume but high-impact sales.

Ciaz

- May 2025 Sales: 458

- Y-o-Y Growth: -37%

- M-o-M Growth: +43%

The Ciaz, a fading sedan, saw a 37% Y-o-Y decline but a 43% M-o-M increase. Its relevance is waning in a market favoring SUVs and crossovers.

Invicto

- May 2025 Sales: 223

- Y-o-Y Growth: +16%

- M-o-M Growth: +11%

The premium MPV Invicto posted a 16% Y-o-Y and 11% M-o-M growth, but its low volumes reflect its niche positioning and high price point.

Summary Table: Maruti Suzuki May 2025 Sales Snapshot

| Category | Model(s) | Performance |

|---|---|---|

| Top Gainers (Y-o-Y) | Jimny, Ertiga, Dzire | Strong double-digit and triple-digit growth |

| Biggest M-o-M Jump | S-Presso (+149%), Jimny (+58%) | Significant monthly surges |

| Top Decliners (Y-o-Y) | Grand Vitara, Celerio, Alto | Steep drops in traditional segments |

| Steepest M-o-M Decline | Grand Vitara (-27%), XL6 (-15%) | Notable monthly corrections |

Key Trends and Insights

The Maruti Suzuki May 2025 sales data paints a picture of a brand navigating a dynamic market. Here are the key takeaways:

- SUVs and MPVs Lead: Models like the Dzire, Ertiga, and Vitara Brezza remain strong, reflecting demand for practical yet modern vehicles. The Fronx and Eeco also hold steady, showing Maruti’s strength in diverse segments.

- Hatchback Struggles: Traditional hatchbacks like the Alto, Celerio, and Baleno are under pressure as buyers shift toward SUVs and crossovers. The Wagon R and Ignis are also losing ground, albeit more gradually.

- Niche Success: The Jimny and S-Presso’s M-o-M surges highlight the potential of targeted, enthusiast-driven models, even in low volumes.

- Premium Challenges: The Grand Vitara and Invicto face headwinds due to pricing and competition, signaling a need for sharper positioning in the premium space.

What’s Next for Maruti Suzuki?

The Maruti Suzuki May 2025 sales report underscores the need for strategic agility. As Indian buyers increasingly favor SUVs, hybrids, and feature-packed vehicles, Maruti Suzuki must:

- Innovate Hatchbacks: Refresh models like the Alto and Celerio with modern tech and styling to regain traction.

- Boost Premium Offerings: Address the Grand Vitara’s decline with competitive pricing or new variants to counter rivals in the midsize SUV segment.

- Leverage CNG and Hybrids: Expand eco-friendly options to align with regulatory shifts and consumer demand for fuel efficiency.

- Target Niche Markets: Build on the Jimny’s success by catering to enthusiast-driven segments with unique offerings.

Conclusion

The Maruti Suzuki May 2025 sales figures reveal a brand at a crossroads. While models like the Dzire, Ertiga, and Jimny showcase Maruti’s ability to adapt, the decline of hatchbacks and premium SUVs like the Grand Vitara highlights challenges. By doubling down on innovation, embracing eco-friendly technologies, and refining its premium strategy, Maruti Suzuki can solidify its dominance in India’s automotive market. As consumer tastes evolve, the road ahead demands bold moves and fresh ideas to keep Maruti Suzuki in the driver’s seat.