In 2024, India took a decisive leap toward greener mobility and energy independence with the nationwide rollout of E20 ethanol blend in India — petrol containing 20% ethanol and 80% fossil fuel. The move aligns with the government’s ambitious biofuel roadmap, aiming to cut carbon emissions, reduce costly crude oil imports, and create new income streams for farmers.

On paper, the benefits are compelling. Ethanol is a renewable fuel made from crops like sugarcane, maize, and surplus grains. It burns cleaner than pure petrol, delivers higher octane ratings for modern engines, and channels billions of rupees into rural economies. The Ministry of Petroleum and Natural Gas has called E20 a “national programme,” vital for meeting climate goals while boosting the agricultural sector.

Yet, as the blend flows into pumps across major cities, the rollout has ignited debate. Vehicle owners — especially those with older models — report noticeable drops in mileage, concerns about engine wear, and confusion over whether warranties or insurance will cover ethanol-related damage. Social media, workshops, and even official advisories from automakers have added to the uncertainty.

This article dives deep into the full story behind the E20 transition: the history of ethanol blending in India, the government’s vision, real-world user experiences, manufacturer and insurer responses, and lessons from countries like Brazil that have mastered high-ethanol fuels. Our aim is to separate fact from fear, offer practical guidance, and explore what lies ahead for India’s ethanol journey — so you can make informed choices at the pump.

A Brief History of Ethanol Blending in India

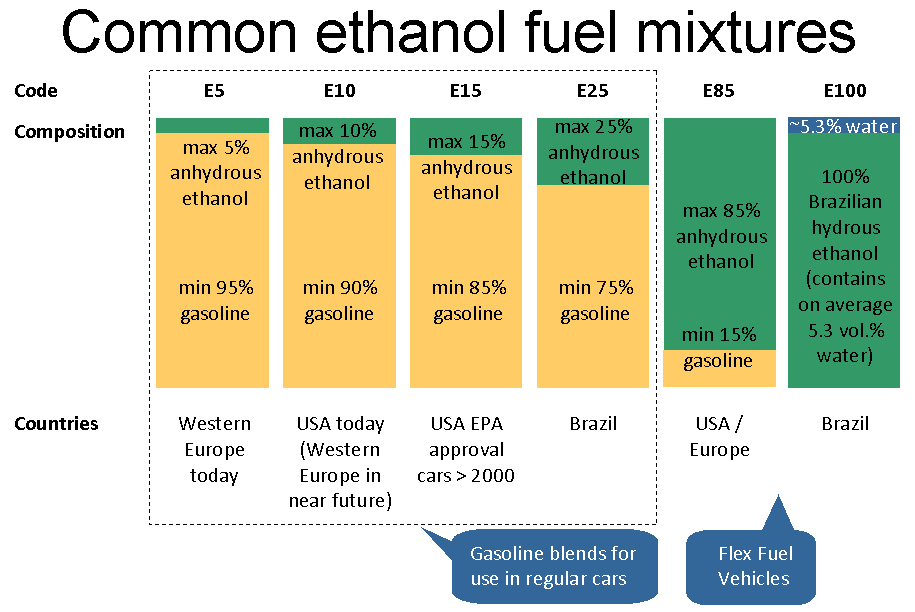

India’s ethanol blending journey began in 2003, when the government introduced E5 — petrol mixed with 5% ethanol — in select sugarcane-rich states like Maharashtra and Uttar Pradesh. The pilot aimed to reduce oil imports and support farmers by creating a market for surplus sugar.

From 2010 to 2014, blending expanded to E10 (10% ethanol) in more regions. While technically successful, the rollout faced hurdles: inconsistent ethanol supply, logistical issues in transporting the alcohol-based fuel, and fluctuating global sugar prices. These challenges slowed the pace, but the policy direction remained clear — biofuels were to be a key pillar of India’s energy strategy.

The real acceleration came in the 2014–2020 period, as oil prices rose and climate commitments sharpened. The government streamlined ethanol procurement, allowed the use of grain-based feedstocks, and set aggressive targets. In 2021, the E20 target year was advanced from 2030 to 2025, signalling a bold shift toward faster adoption.

Recognising the need for vehicle readiness, manufacturers were asked to design engines and fuel systems compatible with E20. As of April 2023, all new vehicles sold in India are required to be E20-compliant. This included changes like ethanol-resistant rubber parts, corrosion-protected fuel lines, and ECU recalibration for combustion efficiency.

By 2024, E20 ethanol blend in India became widely available in urban fuel stations, marking the largest shift in India’s fuel composition in decades. While hailed as a green milestone, it also set the stage for the public debate now dominating headlines.

Government’s Vision and Claimed Benefits

The Indian government sees the E20 ethanol blend in India not just as a fuel choice, but as a strategic step toward a cleaner, more self-reliant economy. In official statements, the Ministry of Petroleum and Natural Gas has outlined multiple benefits spanning economics, environment, and national security.

1. Economic Impact

- Forex Savings: Since 2014, ethanol blending programmes have saved India more than ₹1.44 lakh crore in foreign exchange by reducing crude oil imports.

- Farmer Incomes: In 2024–25 alone, the government projects payments of ₹40,000 crore to sugarcane and grain producers supplying ethanol feedstock.

- Rural Economy Boost: The programme turns farmers into “Urjadaatas” (energy providers) alongside “Annadatas” (food providers).

2. Environmental Gains

-

Lower Carbon Emissions: E20 produces around 30% less carbon emissions than E10, helping meet climate commitments.

-

Higher Octane Rating: Improves combustion efficiency and engine performance, particularly in modern high-compression engines.

-

Cleaner Air: Reduced particulate and harmful gas emissions compared to pure petrol.

3. Energy Security

-

Import Reduction: Less dependence on volatile global crude oil markets.

-

Domestic Production Focus: Promotes local ethanol production, creating jobs in rural and semi-urban areas.

4. Official Position on Safety

The government maintains that E20 is safe for all compatible vehicles. For older vehicles, potential wear is described as minimal and manageable through routine servicing, with no threat to overall roadworthiness.

In short, policymakers frame the E20 rollout as a win-win — delivering cleaner fuel, stronger rural economies, and reduced import dependence — while assuring consumers that compatibility issues are limited to older models.

The Controversy: What’s Fueling the Debate

While the government presents the E20 ethanol blend in India as a green and economic triumph, on the ground, a different narrative is taking shape. Car owners, mechanics, and even some manufacturers are raising red flags over performance, durability, and financial implications.

1. Mileage Drop

-

Official Estimates: Government studies suggest a 1–2% fuel economy drop in E20-calibrated vehicles and 3–6% in older models.

-

User Experience: Social media posts and workshop feedback tell a different story — mileage drops of 10% or more in certain cars and two-wheelers.

-

Root Cause: Ethanol’s lower energy content (about 65% of petrol) means less energy per litre unless the engine is tuned for it.

2. Engine Wear & Corrosion Risks

-

Ethanol absorbs moisture from the air, increasing the risk of water separation in fuel tanks.

-

In humid climates, this can lead to rust, injector clogging, and misfires.

-

Older vehicles, especially pre-2010, have rubber seals and gaskets that may degrade faster when exposed to higher ethanol concentrations.

3. Warranty & Insurance Uncertainty

-

Some automakers, including Toyota, warn that using E20 in incompatible vehicles can void warranties.

-

A viral reply from ACKO Insurance implied no coverage for E20-related damage, later clarified as part of the standard exclusion on non-accident engine failures.

-

Mixed messages from government, manufacturers, and insurers have created confusion and distrust.

Why Older Vehicles Are at Risk

One of the central challenges in the rollout of the E20 ethanol blend in India lies in the country’s ageing vehicle fleet. The average passenger car on Indian roads is over eight years old, with millions of vehicles still in use that were manufactured more than a decade ago. These older models were designed and calibrated for fuels containing little to no ethanol, and in many cases, manufacturers explicitly recommended avoiding blends higher than E10.

The problem is rooted in materials and technology. Ethanol is a solvent and hygroscopic — it absorbs moisture from the air — which can accelerate the corrosion of metal components and degrade certain plastics and rubbers. In older cars and two-wheelers, fuel system parts such as hoses, gaskets, and seals were not made with ethanol-resistant materials. Over time, exposure to higher ethanol levels can cause these parts to swell, crack, or become brittle, leading to leaks or performance issues. Carburettor-based engines, still common in older two-wheelers and small cars, are particularly vulnerable because they lack the protective coatings and closed systems found in modern fuel injection setups.

Manufacturers have issued varying guidance on this matter. Some, like Toyota, have publicly warned that the use of E20 in non-compatible vehicles could result in fuel system damage and void the warranty. Even for brands that have not issued formal advisories, owner’s manuals for many pre-2023 models caution against ethanol content above 10%. This mismatch between the country’s fuel policy and the technical readiness of a large portion of the fleet is at the heart of many consumer concerns.

Brazil’s Ethanol Success Story

Brazil is often cited as the global benchmark for high-ethanol fuel adoption, having built a robust system over several decades. Unlike the rapid nationwide switch to E20 ethanol blend in India, Brazil’s rollout was gradual and carefully matched to technological readiness. Ethanol blending began in the late 1970s with low-percentage mixes, steadily increasing as vehicle technology evolved. By the 2000s, blends of up to E27 were commonplace, supported by an industry-wide shift to flex-fuel vehicles capable of running on petrol, ethanol, or any mixture in between.

The success hinged on engineering changes as much as policy. Fuel system components — from rubber hoses to fuel tanks — were upgraded to be ethanol-resistant. Engines were recalibrated to handle ethanol’s different combustion characteristics, and software systems allowed real-time adjustment depending on the blend. This meant that whether a driver filled up with 100% petrol or pure ethanol, the vehicle could adapt seamlessly without performance loss or damage.

Consumer choice played a critical role. Brazilian fuel stations offered multiple blends, clearly labelled and often priced to favour ethanol when market conditions allowed. This flexibility, combined with extensive public education campaigns, built trust in the system. Drivers understood how the fuels worked, what to expect in terms of mileage, and how to maintain their vehicles.

For India, the Brazilian model offers clear lessons: rollouts must align with fleet readiness, blend options should be clearly available, and consumer trust is essential. Without these pillars, even the best-intentioned fuel programme risks public resistance.

Government vs Ground Reality

The official narrative around the E20 ethanol blend in India is one of confidence and reassurance. Government agencies have repeatedly stated that the blend is safe for all compatible vehicles and that any potential wear in older models is minimal, manageable through routine servicing, and not a cause for alarm. They emphasise that no scientifically confirmed cases of catastrophic engine damage due to E20 have been recorded, and that the programme’s benefits in terms of emissions reduction, energy security, and rural income far outweigh any drawbacks.

On the ground, however, the story is more complicated. Mechanics in various cities report seeing older cars and two-wheelers come in with fuel system issues, injector clogging, or corrosion that owners attribute to the shift from E10 to E20. While some of these problems may be due to poor maintenance or unrelated faults, the timing has led many to draw a direct connection to the new fuel. Workshop advice often leans toward caution, with some mechanics recommending that older vehicles stick to E10 wherever possible.

Social media has amplified these concerns. Posts showing trip computer readouts with steep mileage drops, photos of rusted components, and viral screenshots of insurance queries have spread quickly, fuelling anxiety. Even if the number of genuine E20-related failures is small, the visibility of such stories creates a perception of widespread risk. This perception gap — between official assurances and lived experience — is proving to be one of the greatest hurdles in securing public acceptance of E20.

Insurance and Warranty Clarity

One of the more confusing aspects of the E20 ethanol blend in India rollout has been its impact on insurance and manufacturer warranties. The short answer is that, for most vehicle owners, standard protections remain unchanged — but the details matter.

Standard motor insurance policies in India are designed primarily to cover accident-related damage. They generally exclude mechanical or electrical failures not caused by an accident. This means that if an engine suffers damage from fuel incompatibility, poor maintenance, or normal wear and tear, the claim will likely be rejected — regardless of whether the fuel is E20, E10, or pure petrol.

The recent controversy began when ACKO Insurance replied to a customer query on social media, stating that engine damage due to “incorrect fuel usage” would not be admissible under its policy. The post went viral, interpreted by many as a refusal to cover E20-related issues. ACKO later clarified that this was not a targeted exclusion against ethanol-blended fuel, but rather a standard industry-wide clause. They also stated they are studying E20’s technical impact and may consider specialised coverage if warranted.

On the warranty side, automakers have a clearer stance: vehicles manufactured after April 2023 and marked as E20-compatible remain covered. However, for older, incompatible models, manufacturers like Toyota have explicitly stated that damage caused by using blends above the recommended limit could void warranty claims. This makes checking your vehicle’s official ethanol compatibility — as stated in the owner’s manual — more important than ever.

Practical Advice for Vehicle Owners

For motorists navigating the shift to the E20 ethanol blend in India, a few practical steps can help reduce risks and avoid unpleasant surprises.

The first step is to confirm your vehicle’s ethanol compatibility. This information is usually found in the owner’s manual or on a sticker near the fuel cap. Vehicles manufactured after April 2023 are generally E20-ready, but older models may be certified only for E10. If the documentation isn’t clear, contact your dealer or the manufacturer directly for confirmation.

When buying fuel, pay attention to pump labelling. E20 nozzles are marked, but the signage can be small and easy to miss. In areas where both E10 and E20 are available, choose the blend recommended for your vehicle. Keep fuel receipts — ideally with the ethanol percentage noted — and log your mileage. Over time, this record can help identify any unusual drops in efficiency or performance changes.

Ethanol’s solvent properties can loosen deposits in fuel systems, leading to clogged filters. For older vehicles, more frequent fuel filter changes and inspections of hoses and gaskets are advisable. Cold-start issues in winter can sometimes be mitigated by keeping the tank above half-full to reduce moisture condensation.

Finally, consider whether an engine protection add-on to your motor insurance is worth the cost. While it won’t make your car E20-compatible, it can cover certain non-accident engine failures, adding an extra layer of financial security during this transition.

Recommendations to Smooth the Transition

For the E20 ethanol blend in India to gain public trust and deliver its promised benefits, the rollout must be accompanied by practical measures that address consumer concerns head-on.

One immediate step is improved pump labelling. Current E20 markings are often small and inconspicuous, leading to accidental misfuelling. Clear, colour-coded labels — similar to Brazil’s system — would make it easier for drivers to identify the correct blend. Alongside this, fuel receipts should clearly state the ethanol percentage, giving owners a transparent record of what they purchased.

Maintaining dual availability of E10 and E20 during the transition period, especially in rural areas and regions with older vehicle fleets, would give consumers choice and reduce the risk of damage to incompatible engines. This should be paired with independent, long-term durability testing by agencies like ARAI or IIT-Kanpur, with findings shared publicly to build confidence.

To encourage faster fleet modernisation, the government could offer incentives for scrapping or upgrading old vehicles. Retrofit kits for certain models could also help bridge the compatibility gap. Meanwhile, aligning warranty and insurance policies so that consumers get consistent information from manufacturers, insurers, and the government would eliminate much of the current confusion.

Finally, pricing can be a powerful adoption tool. In Brazil, ethanol is often sold cheaper than petrol to encourage voluntary use. Similar pricing strategies in India could make E20 not just an environmental choice, but also a financially attractive one for everyday drivers.

The Road Ahead

The rollout of the E20 ethanol blend in India is only the first major milestone in the country’s broader biofuel journey. Government policy documents already outline a long-term roadmap that could see ethanol blends rise to E27 or even E30 in the coming years. The ambition is to match global leaders like Brazil in both blending levels and domestic production capacity, positioning India as a biofuel hub.

However, moving beyond E20 will require meeting several critical preconditions. Fleet readiness is at the top of the list. While all vehicles manufactured after April 2023 are E20-compatible, transitioning to higher blends would require an even more ethanol-resilient fleet — potentially flex-fuel vehicles capable of running on a range of blends without performance loss or damage.

Supply stability is another key factor. Scaling up to higher blends means significantly expanding ethanol production capacity without compromising food security or driving up commodity prices. This requires long-term investments in processing facilities, diversified feedstock sources (including non-food crops), and efficient distribution networks.

Finally, perhaps the most important precondition is consumer trust. Without clear communication, transparency in testing, and alignment between government, manufacturers, and insurers, public scepticism could slow adoption. Brazil’s experience shows that acceptance grows when drivers have choices, see pricing advantages, and understand the technology.

If India can balance these elements — readiness, stability, and trust — the road ahead could lead to a cleaner, more energy-secure future powered by homegrown biofuels.

Conclusion

The E20 ethanol blend in India represents one of the most ambitious steps the country has taken toward cleaner mobility, reduced oil dependence, and greater economic resilience. It is more than a fuel change — it is a shift in how India powers its vehicles, supports its farmers, and meets its climate commitments. The potential benefits are clear: lower carbon emissions, a boost to rural incomes, and billions saved in foreign exchange.

Yet, as with any major policy transition, ambition must be tempered with practical readiness. Millions of older vehicles on Indian roads were not built for high-ethanol blends, and pushing too far, too fast risks eroding public trust. Brazil’s success shows that such programmes work best when vehicle compatibility, infrastructure, and consumer education evolve in step with fuel policy.

For vehicle owners, the key is informed caution. Check your car’s ethanol compatibility, choose the correct blend at the pump, maintain your vehicle diligently, and consider insurance add-ons if appropriate. Awareness and preventive care can go a long way in avoiding potential pitfalls.

Ultimately, the success of E20 will hinge on India’s ability to blend not just ethanol with petrol, but technology, transparency, and trust into its energy strategy. If the government, automakers, and insurers can work together to address concerns openly and support consumers through this transition, E20 could become a cornerstone of India’s green energy future — paving the way for even higher blends and a more self-reliant nation.